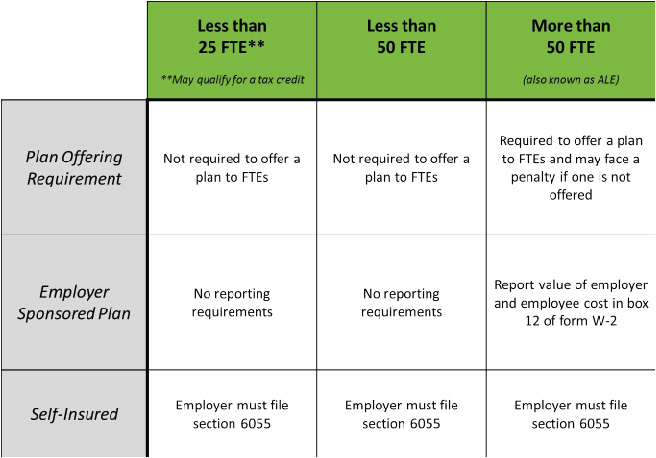

Employer Reporting

Employers with Less than 25 FTEs

Plan Requirement:

Employers who employ less than 25 full-time equivalent employees are not required to offer a plan.

Reporting Requirement:

- Employers who offer an employer sponsored plan are not required to meet any reporting requirements at this time.

- Effective March 10, 2014 employers offering a self-insured plan must file section 6055.

Tax Credit:

Employers with less than 25 FTEs may qualify for a tax credit.

- To be eligible for the credit a small employer must pay premiums on behalf of its employees enrolled in a qualified health plan offered through the Small Business Health Options Program (SHOP) Marketplace

- The credit is available to eligible employers for two consecutive taxable years

For more information on the tax credit visit www.IRS.gov

Employers with Less than 50 FTEs

Plan Requirement:

Employers who employ less than 50 full-time equivalent employees are not required to offer a plan.

Reporting Requirement:

- Employers who offer an employer sponsored plan are not required to meet any reporting requirements at this time.

- Effective March 10, 2014 employers offering a self-insured plan must file section 6055.

All Employers (More than 50 FTEs)

Plan Requirement

Employers with more than 50 FTEs are required to offer a plan to FTEs and may face a penalty if one is not offered.

Reporting Requirement:

- Employers who offer an employer sponsored plan are required to report the value of employer and employee cost in box 12 of form W-2

- Employers offering a self-insured plan must file section 6055.

- ALEs need to provide Form 1095-C to their employees by January 31 every year to use when filing tax returns. Form 1094-C needs to be provided to be filed with the IRS as a summary of aggregate employer-level data, including FTE counts by month. Contact your payroll vendor for help with the monthly tracking.